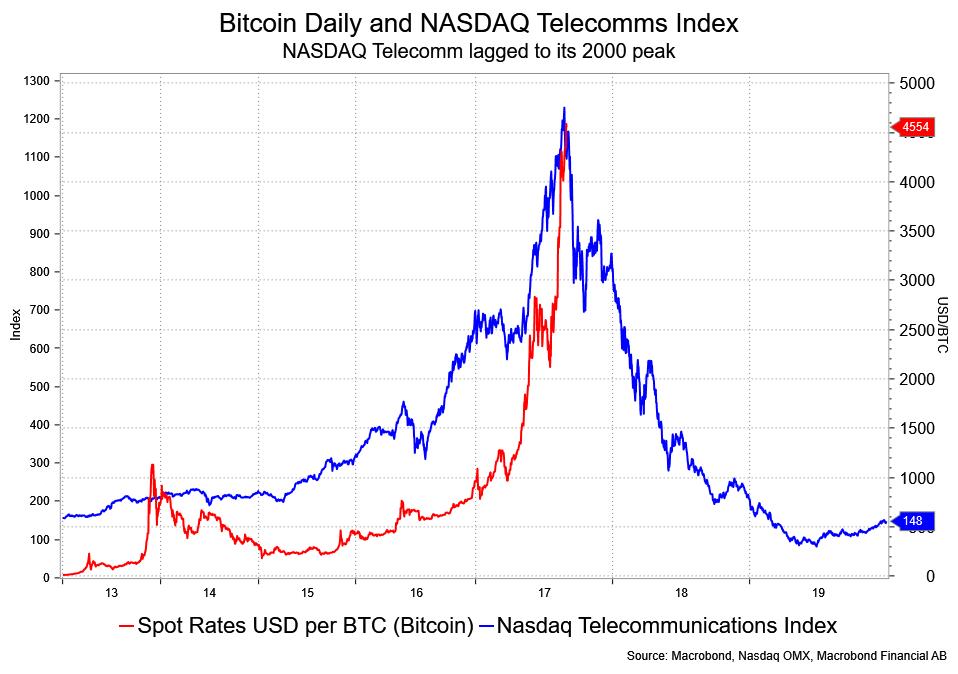

When charted, bitcoin's rapid gains resemble how stocks surged into the tech bubble before collapsing.

David Ader, chief macro strategist at Informa Financial Intelligence, matched a graph of the Nasdaq Telecommunications Index at its peak in 2000 to bitcoin's five-year run to all-time highs.

"This is the price chart for an overly frothy market, in my opinion. I just don't see anything quite as comparable to this in bubblelicious terms," said Ader, a former top-rated bond market strategist.

Bitcoin climbed more than 3.7 percent Thursday to a record of $4,802.74, up nearly five times in price this year and about 67 percent higher for August, according to CoinDesk.

Source: Informa Financial Intelligence

"I think it's going to come to a sorry ending," Ader said. "I don't know anybody who's actually used a bitcoin for any purpose legal or otherwise. This looks like an overly frothy market and frothy markets lose their froth."

Ader said he used the Nasdaq telecom index since many of those stocks led the Nasdaq composite's overall gains during the tech bubble. The Nasdaq telecom index shot up more than 700 percent from 1995 to 2000, before collapsing 90 percent in the next two years. The index remains about 75 percent below its record high.

Bitcoin's meteoric surge this year comes as many on Wall Street are becoming more interested in the digital currency and the blockchain technology behind it. New digital asset investment funds are rolling out and the Chicago Board Options Exchange is planning to launch bitcoin futures.

Many investors also bought bitcoin this month after it survived a relatively uneventful split on Aug. 1 into bitcoin and bitcoin cash, an alternative version supported by only a few developers. Bitcoin cash is up about 180 percent from its Aug. 1 low, to Thursday's price of $588, according to CoinMarketCap.

However, bitcoin could split again this fall because there's another upgrade proposal, and others have warned that the speculative forces behind bitcoin could quickly turn against it.

Here are a few of the alarm bells sounded this summer:

- The Elliott Wave Newsletter predicted bitcoin's surge from 6 cents in 2010, but in July said bitcoin's surge has surpassed the tulip mania of roughly 400 years ago and is now showing signs of nearing a sharp downturn.

- Later in July, widely followed Bank of America Merrill Lynch commodity and derivatives strategist Francisco Blanch concluded in a sweeping report that bitcoin still faces many challenges to becoming a globally accepted currency.

- Then about a week later, a New York University finance professor, Aswath Damodaran, said in a blog post that bitcoin may just be a "dangerous pricing game."

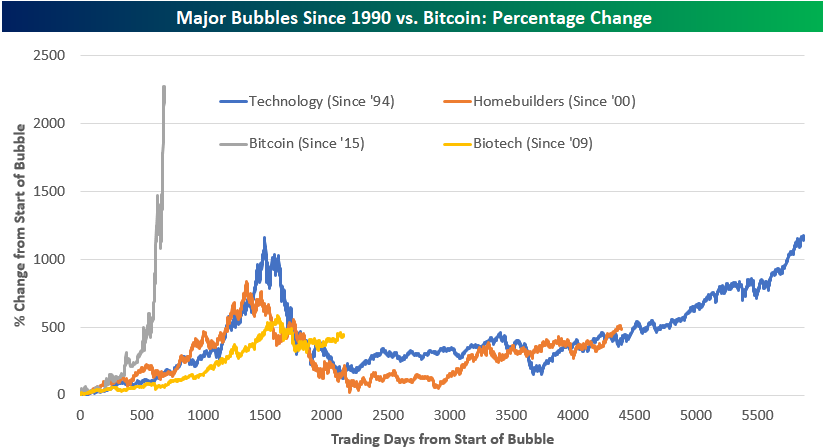

By percent change, analysis from Bespoke Investment Group shows how bitcoin's surge has already well surpassed that of any major stock market bubble.

Source: Bespoke Investment Group

That said, some well-respected names on Wall Street have also issued positive reports on the digital currency.

- In early July, Thomas Lee became the first major Wall Street strategist to issue a report on bitcoin. A former JPMorgan strategist who co-founded Fundstrat, Lee said bitcoin could reach $20,000 to $55,000 by 2022. On Aug. 18, he established a mid-2018 target of $6,000 for bitcoin.

- According to a mid-July Forbes report, investing legend Bill Miller put 1 percent of his net worth into bitcoin in 2014, and the digital currency is one of the top holdings in Miller's $120 million hedge fund.

- Stock analyst Ronnie Moas of Standpoint Research published a report in late July predicting bitcoin would rise nearly 80 percent to $5,000 in 2018. He then raised that target in mid-August to $7,500.

Lee and Moas both reason that bitcoin can climb to those levels if even a fraction of the trillions of dollars in gold or other traditional investments move into the digital currency.

Bitcoin has a market value of about $78 billion, and digital currencies overall are worth $170 billion, according to CoinMarketCap.

That makes the value of all digital currencies less than 5 percent of the more than $4 trillion inflation-adjusted value of stocks during the tech and telecom boom, said Chris Burniske, author of the upcoming book, "Cryptoassets: The Innovative Investor's Guide to Bitcoin and Beyond."

"If people think this is the 'big bubble,' then they don't have an appreciation for how big the idea of cryptoassets really is," he said.

Many digital currency enthusiasts agree there is speculation in the digital currency. But they note that, just like the dot-com bubble, companies that were able to utilize the underlying technology then became global giants.